We find that the key reason most Australians do not have greater financial security as they enter retirement is that they’ve been too focused on trying to pay off their mortgage.

While paying off the debt on the family home should be one of your financial goals, it should not come at the cost of greater financial security through wealth creation strategies.

We often hear clients say that they’d love to invest in shares or property but have very little left over after paying the mortgage and other living costs.

The truth is that investing, and more still, borrowing to invest, can be a very important part of overall wealth creation and in particular debt or mortgage reduction.

In fact there are many mortgage brokers that will provide you with a variety of options to help you pay down your mortgage faster.

And while the bank will want you to think otherwise, there are several mechanisms for reducing your mortgage and owning your own home faster without increasing your minimum monthly repayments.

How to build wealth over time

There are only a few ways to build more wealth over time. The slow way is to put all your savings into a bank account. A faster and more effective way is to accumulate growth assets and drive down debt.

Using the second model Australians can not only build wealth over time but reduce their debts and have income producing assets to give them greater financial security and choice during retirement.

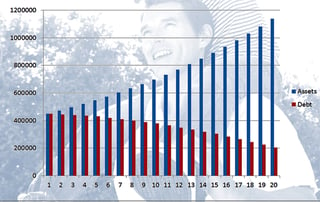

Scenario 1 – the average Australian pays off their mortgage over time

In this case an average Australian family buys an average Australian home for around $450,000 and pays the minimal monthly repayments using a basic principal and interest loan on the average standard variable rate over time.

After 20 years the average Australian family has improved their wealth as their average Australian home has conservatively grown on average at just 5 percent per annum and is now worth approximately $1.1m.

However there are two issues with this scenario. The first being that there is still approximately $200,000 worth of debt left on the family home.

The second and most important issue, given that all their wealth is tied up in the family home, is that there is no income generated from this significant asset.

The risk for this average Australian family is that they take 30 years to finally pay off the family home and enter retirement without any other major assets to provide net investment wealth or income.

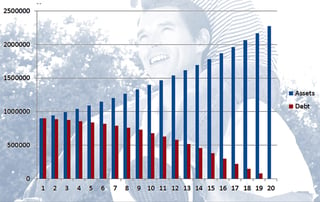

Scenario 2 – the above average Australian family invests and uses a mortgage reduction program

In this case the above average Australian family also buys an average Australian home for around $450,000. However around the same time they also buy another average Australian home as an investment property.

Because the investment property provides them with increased net cash flows each week through rental income and tax benefits, they work with their mortgage broker to take advantage of this increased cash flows as part of a mortgage reduction program.

The result of offsetting this extra income as part of a mortgage reduction program is that the above average Australian family is able to pay down their debt much faster which makes a considerable difference to their wealth over the same 20 years.

In fact their $900,000 property portfolio has conservatively grown on average at just 5 percent per annum and is now worth approximately $2.15m.

In this scenario, using the mortgage reduction program, the above average Australian family is able to pay off all their debts in just under 20 years.

The key advantages here is that they have paid off their own home faster, but they also have an investment property which is providing rental income and some tax benefits as they enter the next part of their lives or retirement. They have greater financial security and choice.

Mortgage reduction programs

The key to a good mortgage reduction program is using capital to offset debt and reduce the exposure to interest. There are a few simple ways to pay off your mortgage years faster saving you time and money.

Change your payment frequency

The first way is to immediately change your payment frequency from minimal monthly repayments to either fortnightly or weekly repayments.

Given that interest is calculated daily, even if you still make the minimal payment required, the increased repayments and frequency will reduce your interest exposure and have a positive impact on the time it takes to pay off your mortgage.

Depending on the size of your loan, simply changing your payments from monthly to fortnightly can save you several years and tens of thousands of dollars on the average 30 year loan.

Use an offset facility

The second way to pay off your home loan faster is the work with your broker to put in place an offset facility and a mortgage reduction plan.

By changing your savings account to an offset facility, and directing all your income into the offset facility, each dollar in the facility is now offsetting your mortgage and your exposure to interest is less. This means your interest is now being calculated off a lower base mortgage and when you continue to pay the minimal fortnightly repayment, more of this repayment is being directed towards the principal of your loan rather than the interest component. The result over time is that the more you have in your offset, the more you offset your loan and exposure to interest, and the sooner you pay off your mortgage.

Depending on the size of your loan and living budget, simply changing to an offset with fortnightly payments as part of a proper mortgage reduction program can save you significant time and dollars on the average 30 year loan. The key is the more money you put in the offset, the faster you pay off your mortgage.

Invest in property

The third and most effective way to pay off your home loan faster is to combine an income producing investment portfolio with your mortgage reduction program. Noting from point two that the more money you drive into the offset account, the faster you pay off your mortgage – the critical factor is more money.

By adding an investment property to your portfolio and mortgage reduction program, you can pay off your mortgage even faster.

In this case all of your income, all of your rental income and your tax benefits build up in your offset. The increased sum allows you to further lower your calculated mortgage base, exposing you to less interest. Each mortgage payment directs even more towards the principal of your loan rather than the interest component.

By adopting this strategy and other payment models in a sophisticated mortgage reduction program our clients save up to 50 percent of the time it takes to pay off their mortgage and hundreds of thousands of dollars.

Consider your overall financial goals

Achieving the benefits of successful property investment is more than just purchasing a property. It should be part of a program which considers your overall financial goals in cooperation with your other financial strategies. You should consider tax effectiveness, yield, mortgage reduction programs, and long term capital growth for increased net wealth as part of your propery investment plan.

The FRD Client Investment Program alongside a proper mortgage reduction strategy from AIM Finance Australia can help you achieve some of these goals in a passive and effective way that will not impact your cash flow, your lifestyle and other investment strategies.